Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

🏦 Open a U.S. Bank Account – Quick Steps

✅ Choose a bank

✅ Prepare ID, SSN/ITIN, and address proof

✅ Apply online or at a branch

✅ Deposit $25–$100

✅ Start using online banking

For Non-Residents: Passport, visa, ITIN, and in-person visit may be required.

Popular banks: Chase, Bank of America, Citibank, HSBC, Wells Fargo

৳ 550 Original price was: ৳ 550.৳ 350Current price is: ৳ 350.

Any US Bank Account Bangla Method

Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

🏦 Open a U.S. Bank Account – Quick Steps

✅ Choose a bank

✅ Prepare ID, SSN/ITIN, and address proof

✅ Apply online or at a branch

✅ Deposit $25–$100

✅ Start using online banking

For Non-Residents: Passport, visa, ITIN, and in-person visit may be required.

Popular banks: Chase, Bank of America, Citibank, HSBC, Wells Fargo

৳ 550 Original price was: ৳ 550.৳ 350Current price is: ৳ 350.

Description

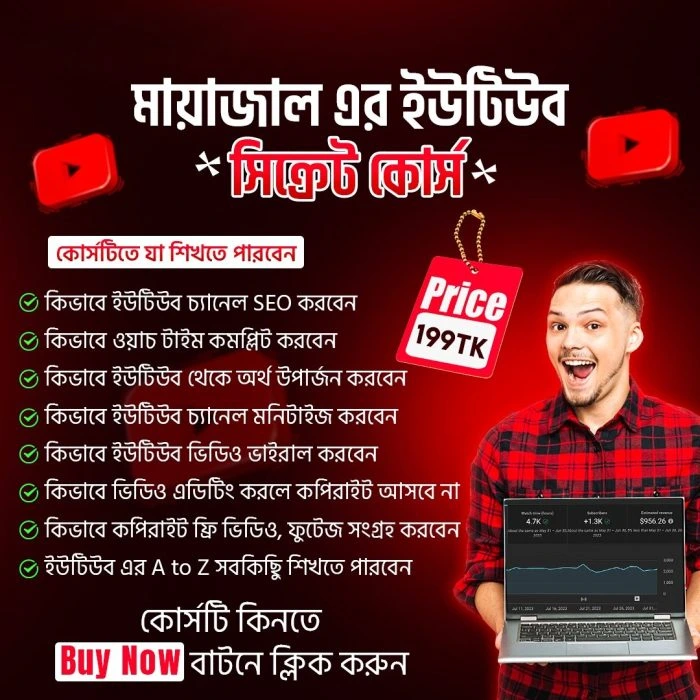

🇺🇸 How to Apply for a U.S. Bank Account – A Complete Step-by-Step Guide

Looking to open a U.S. bank account? Whether you’re a citizen, resident, or international visitor, this comprehensive guide will walk you through the full process — from choosing the right bank to submitting your documents and gaining access to secure, efficient financial services.

🌟 Why Open a U.S. Bank Account?

A U.S. bank account is more than just a place to store money. It offers:

-

Secure Transactions: Your funds are protected under FDIC insurance and advanced security measures.

-

Build U.S. Credit History: Essential for future loans, rentals, or credit card access.

-

Easy International Transfers: Fast, cost-effective money transfers — ideal for business and personal use.

Whether you travel frequently, run a business, or plan to move to the U.S., having a U.S. bank account streamlines your financial life.

🏦 Types of U.S. Bank Accounts

Choose the account that fits your financial needs:

-

Checking Account: For everyday transactions, bills, debit card use, and direct deposits.

-

Savings Account: Earn interest while saving money; withdrawal limits usually apply.

-

Certificate of Deposit (CD): Higher interest rates in exchange for fixed-term deposits.

📋 What Documents Do You Need?

✅ For U.S. Citizens & Residents:

-

Government-issued ID (Driver’s License or Passport)

-

Social Security Number (SSN)

-

Proof of U.S. address (utility bill, lease, etc.)

🌍 For Non-U.S. Residents:

-

Valid Passport

-

U.S. Visa or Entry Documentation

-

Individual Taxpayer Identification Number (ITIN)

-

Proof of Foreign Address

⚠️ Not all banks support non-resident applications — always check eligibility first.

📝 How to Apply for a U.S. Bank Account – Step-by-Step

-

Research Banks

Compare fees, services, and residency requirements across banks. -

Collect Required Documents

Have all ID and tax documentation ready (SSN or ITIN). -

Choose Account Type

Decide based on your needs: checking, savings, or CD. -

Apply Online or In-Branch

Residents often apply online. Non-residents may need to visit a branch. -

Deposit Initial Funds

Most banks require a small deposit ($25–$100). -

Activate Online Banking

Once approved, you’ll receive login details for online access and mobile banking.

🌐 Applying as a Non-Resident

Some U.S. banks are known for accepting non-resident applications:

-

Wells Fargo – Great in-person support and flexible account types

-

Citibank – International-friendly and globally recognized

-

HSBC – Tailored for global customers and non-residents

-

Bank of America – Extensive support with low minimum deposits

-

Chase Bank – Offers robust mobile banking and global ATM access

🔑 Tips for Non-Residents:

-

Get an ITIN if you don’t have an SSN

-

Be prepared for in-branch applications

-

Bring translated and notarized documents if needed

✅ Final Thoughts

Opening a U.S. bank account is a valuable financial step — whether for travel, study, business, or relocation. With proper preparation and this guide, you can apply smoothly and start enjoying the full benefits of U.S. banking.

🔖 Hashtags:

#USBankAccountGuide #OpenBankAccountUSA #NonResidentBanking #USABankingTips #DigitalBanking #InternationalBanking #OpenAccountOnline #USFinanceGuide #BankingForForeigners #StepByStepBanking #HSBC #ChaseBank #Citibank #SecureBankingUSA

Reviews

There are no reviews yet